Artikel

23

januari

The essential elements of a direct-to-consumer strategy

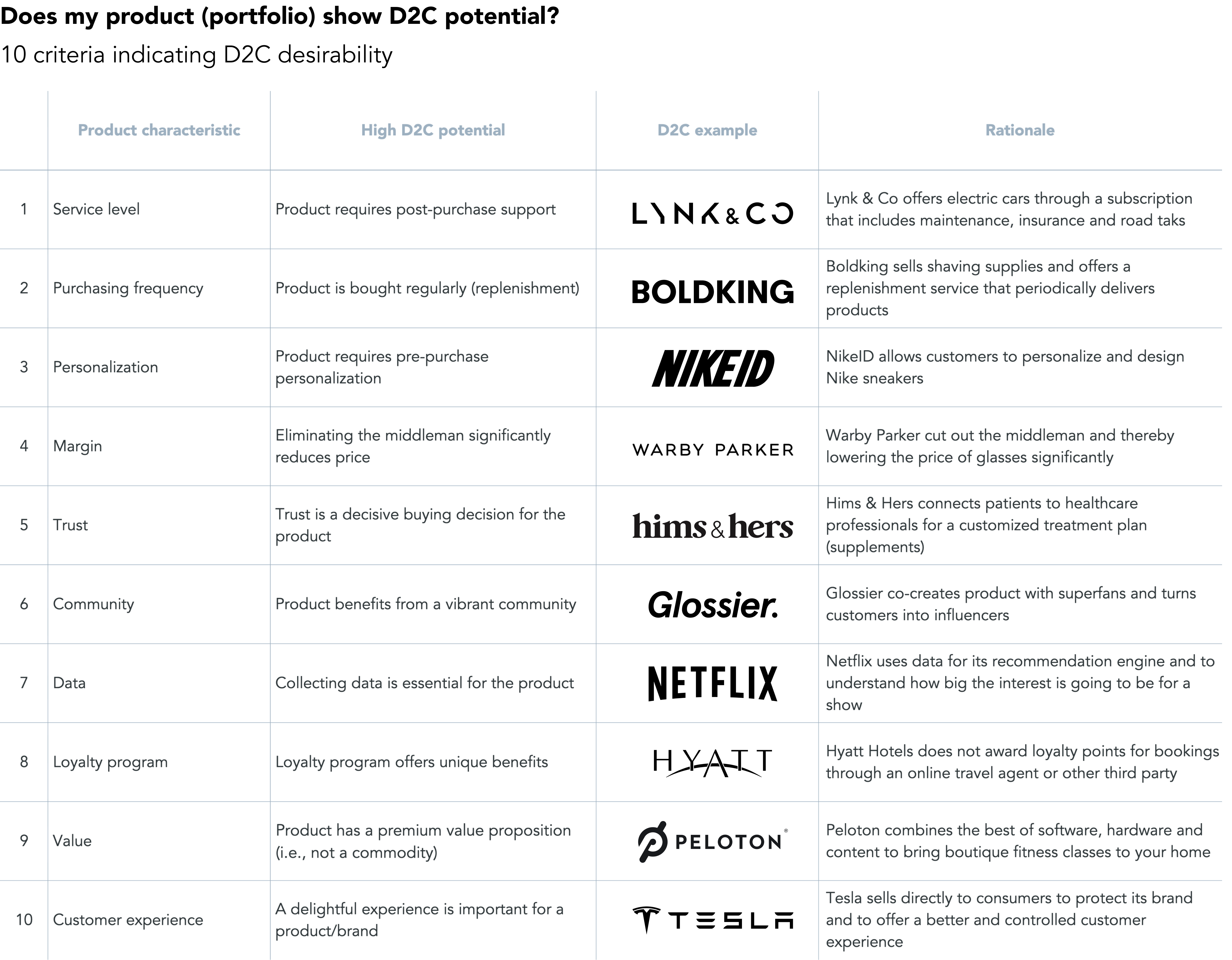

Direct-to-consumer sales (or: D2C) are accelerating and account for one in six ecommerce euros for consumer brand manufacturers in Europe. D2C means skipping the middleman (like distributors, wholesalers and retailers) in the supply chain to sell directly to the end customer. While the D2C trend took off with digital native niche brands, it’s increasingly being embraced by producers with traditionally an intermediary sales focus, but with mixed results. In this article, our colleague Sander van der Noordaa explains why a D2C strategy can be useful and how best to go about it.

Why D2C is gaining popularity

The popularity of D2C is driven by both changing consumer preferences and market dynamics. From a demand side, consumers increasingly shop online for everyday purchases like groceries but also more and more for bigger expenses like buying a car or financial products. From a supply side, there is an increase in the number and reach of intermediary platforms like Bol, Independer, Thuisbezorgd, and Booking. As a result, established producers are increasingly losing the interaction, and thus margin (on average 15%), with the end customer. In response, established producers try to launch D2C channels with a buy or build strategy.

5 key motivations to consider D2C

The pandemic has put D2C on the C-suite agenda and organizations pursue a D2C strategy for the following key reasons.

1 Grow the business

Organizations are able to create an extra channel for growth by selling directly to customers, in addition to already existing offline channels and online sales through marketplaces and e-tailers. D2C provides an opportunity to tap into the ever growing presence of online customers without relying on partners.

2 Secure margin

By selling directly to end customers, instead of through costly (r)etailers, wholesalers or marketplaces, organizations can secure a higher margin. Or as Jeff Bezos puts it: “Your margin is my opportunity”. Nike is a case in point with sales margins of 62% via D2C versus 38% via wholesale.

3 Monetize first-party data

By selling directly to end customers, organizations gather first-party data which enables a personalized experience. This puts organizations in a position to successfully up-sell and cross-sell, and optimize marketing in real-time. Direct customer feedback can also be used to identify latent needs and co-create new products and services. These more intimate customer relationships lead to higher loyalty and repeated purchases.

4 Build a community

It’s easier to build communities when selling directly to end customers. These communities boost trust, authenticity, and loyalty. Lululemon, a D2C focussed athletic apparel retailer, has taken a community-driven approach to promoting the brand. As a result, its customer acquisition costs are extremely low relative to customer lifetime value, as the brand spends less than any peers on marketing.

5 Controlling the brand experience

Organizations are able to fully control the brand image, customer experience, offering and pricing by selling directly to end customers. While the majority of Apple’s revenue comes from indirect channels, the Apple Stores are a major contributor to its brand image and success.

Six essential elements of a successful D2C strategy

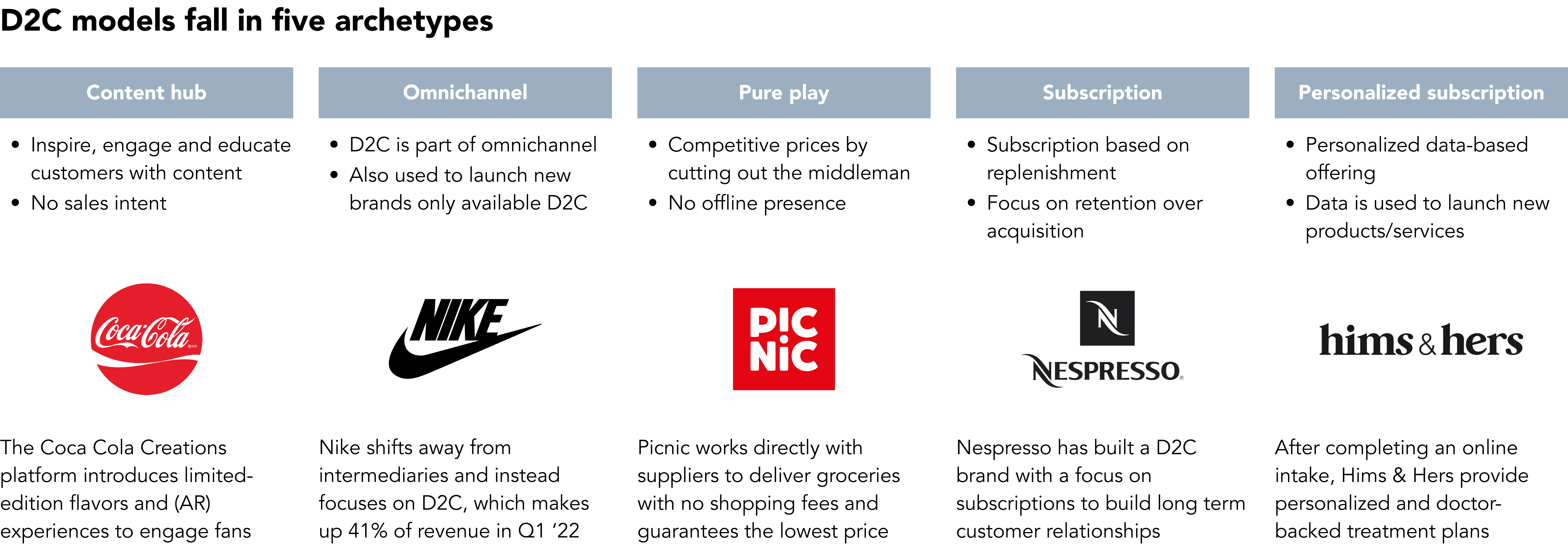

Based on our experience with designing D2C strategies across multiple sectors (such as retail, consumer goods, automotive, financial products and travel & tourism) we believe in a hybrid approach. This means launching new D2C propositions while fostering existing partnerships with intermediaries (read more about how to beat the competition on marketplaces here). Such a hybrid approach enables growth, higher margins, more intimate customer relationships, and cross-channel synergies. At Newcraft we identify the following key criteria for a D2C strategy.

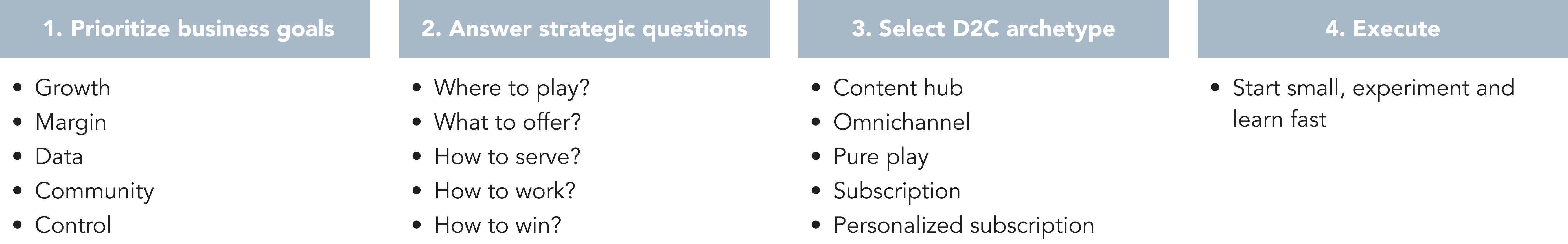

1 What to aspire: state a business objective that unlocks (omnichannel) value

The business objective needs to be clear and quantified before launching a D2C strategy. It can be to boost sales, increase profit, build more intimate customer relationships, differentiate the brand, or something else. It’s also important to understand how this relates to your digital or omnichannel strategy. The objective can change over time based on the product life cycle. Organizations launching new products or entering new geographies will likely focus on sales and brand building. Established brands on the other hand might be more oriented toward building customer relationships.

2 Where to play: identify growth segments without disturbing existing market structures

For a successful D2C strategy the right customer segments, geographies, and channels need to be determined on a corporate level to optimize the sales channel mix and leverage cross-channel synergies. To identify customer segments that are most likely to be D2C oriented, established organizations can segment customers based on recency, frequency, and monetary value of purchases. This segmentation can be complemented for the most attractive segments with personas that include customer needs, wants, and pain points.

An omnichannel mindset

Although organizations are no longer limited by geography when selling D2C, it is important to consider the logistical difficulties when serving these customer segments. Existing relationships with intermediaries also need to be considered because when a business starts with D2C, it might cannibalize sales from existing channels. Ideally, channels should be complementary but this requires an omnichannel mindset. A revenue, profit, and risk analysis across channels could help to adopt an omnichannel focus instead of a single channel focus.

Partnerships with intermediaries are in many cases still important because they represent a large share of sales. Over time, efforts can be geared towards D2C and cannibalized sales can be compensated with higher margins.

3 What to offer: craft a winning business portfolio through complementary offerings

Leading organizations actively manage their business portfolio. D2C provides full control to determine the product- and service offering. Differentiation between channels based on brands, products, services, content, pricing and promotions may lead to a broader audience and possibly avoids conflicts with partners. For example by selling premium or personalized products via D2C, and lower value products without services via intermediaries.

Add-ons and subscriptions

Another option is to focus the D2C offering on building long-term customer relationships by offering add-ons like service contracts or subscriptions. In addition to subscriptions, D2C is also well suited for premium products with a high order value and good margins because this compensates the logistics– and customer acquisition costs.

4 How to serve: create a superior customer experience to differentiate from the competition

With D2C consumers need to be convinced to buy from you rather than from a (r)etailer or marketplace. This awareness stage starts with targeted advertising and search engine optimization. This should not be underestimated because relying on footfall or traffic from the intermediary is not an option anymore. In the consideration stage, high-performing D2C brands communicate a unique value proposition (e.g. lower price, personalization, or post-purchase support) and leverage engaging (user-generated) content and reviews. In the purchase phase, D2C brands entice customers with subscriptions, promotions or upgrades. In the retention phase, D2C brands can offer loyalty points, post-purchase support, or ask consumers to share brand stories and become part of a community.

Personalization and loyalty

In this process, D2C has an advantage over other channels because first-party data and more intimate customer relationships can be leveraged to create a better customer experience. Also, insights gathered can be used to better tailor loyalty programs (read more about how to set up a successful loyalty program here). For example, data gathered via D2C can be used to personalize omnichannel experiences. An important benefit, given that one-fifth of the consumers chose D2C over intermediaries because of the loyalty program.

5 How to work: transform the operating model to compete with digital natives

While many intermediaries have a tech-first operating model, this is often not the case for established producers. Therefore, they need to organize themselves around the end-to-end customer journey. This helps to achieve consistency across channels and alignment behind a common goal as opposed to a silo focus based on products or departments. Established producers who launch D2C for the first time need to realize that D2C requires a different mindset, skillset, and toolset in each step of the customer journey.

Autonomy

From an organizational design perspective, the challenge is to ensure that the D2C business has sufficient autonomy (i.e. dedicated teams and ensuring that IT developments do not become part of the IT roadmap of the parent organization to avoid delays) while maintaining synergies (i.e. increased omnichannel profits, and data sharing).

Capabilities

A new sales channel requires additional resources from different departments. For example, delivering smaller order sizes (from pallet to package) has an impact on many parts of the supply chain. Therefore, key D2C capabilities need to be developed or re-designed like last-mile supply chain management, online sales, online marketing, data and analytics, and omnichannel expertise.

Reporting

Furthermore, digital native brands benefit from a tech-first operating model through instant sales reporting. Brick and mortar brands, on the other hand, are often used to weekly or monthly reporting. As such, they need to invest in data and digital talent to act swiftly and optimize marketing strategies.

Operations

To build a future-ready business, organizations can choose to upskill, recruit, or outsource based on how important each capability is for its competitive advantage. However, if D2C is a stretch from the current operations and operated as an independent business, it might be wise to start with outsourcing to quickly scale with the right expertise.

6 How to win: create a scalable business model with a build-measure-learn cycle

When a new D2C business is being rolled out, it is important to start small, experiment, and learn fast to get the economics right before scaling. In the startup phase, the focus should be on validating consumer demand and order economics (margin). At a later stage, the focus should be on reaching at least a customer lifetime value to customer acquisition cost ratio of 2:1 before scaling.

Measure omnichannel performance

Organizations need to allocate sufficient resources and adopt a long-term focus because profitability might not be immediate or the sole purpose. To assess the monetary impact it is important to measure profitability based on omnichannel performance instead of single channel. Therefore, the business case needs to include omnichannel second-order effects which could be Research Online Purchase Offline (ROPO), increased loyalty and repeat purchases due to an increase in community members, and brand differentiation.

These second-order effects can be hard to measure. For instance, assessing the ROPO effect, which shows the impact of online channels on physical channels, often requires advanced analytics or expert estimations.

Lastly, a development backlog, headed by an experienced ecommerce product manager, should be created with prioritized initiatives based on impact, effort, and dependencies.

This is a successful D2C strategy

A successful D2C strategy has a positive return on investment and/or functions as an innovation platform. This can be achieved by following these steps:

What's your reaction ?

Follow us on Social Media

Some Categories

Recent posts

November 22, 2024

Loonkosten 2025: hier kun je als werkgever op rekenen

November 20, 2024

Books Article

November 19, 2024

Hoe Aristoteles nu zorgt voor impactvolle communicatie

November 16, 2024

Loonkosten 2025: hier kun je als werkgever op rekenen

November 09, 2024

Dit betekent het regeerakkoord voor jou als ondernemer

Inloggen

Inloggen

Registreren

Registreren

Comments (0)

No reviews found

Add Comment