Artikel

04

januari

How to Protect Your Crypto Assets from Market Volatility

Essential Strategies to Shield Crypto assets from Market Volatility in 2024

Cryptocurrency, with its promise of revolutionary change in finance, has attracted a diverse range of investors and enthusiasts. However, the crypto market is notoriously volatile, with prices often experiencing significant fluctuations in short periods. This volatility can be a major concern for investors, particularly those new to the space. In 2024, as the market matures, understanding how to protect your crypto assets from this volatility becomes crucial. Here’s a comprehensive guide to navigating the choppy waters of the crypto market.

1. Understanding the Market:

The first step in protecting your assets is understanding what drives market volatility. Factors such as regulatory news, technological advancements, market sentiment, and macroeconomic trends can significantly impact cryptocurrency prices. Staying informed and understanding these factors can help you make more educated decisions.

2. Diversification:

Diversification is a key strategy in any investment, including crypto. Don’t put all your eggs in one basket; spread your investment across different cryptocurrencies and even different asset classes. This approach can help mitigate risk, as different assets may not all react the same way to market changes.

3. Long-Term Holding (HODLing):

One common approach among crypto investors is ‘HODLing’, or holding onto your investment for a long term, regardless of volatility. This strategy is based on the belief that, despite short-term fluctuations, the value of well-researched and solid cryptocurrencies will increase over time.

4. Use of Stablecoins:

Stablecoins, whose values are pegged to more stable assets like the US dollar or gold, can be a safe haven during periods of high volatility. Converting a portion of your portfolio to stablecoins when the market is unstable can protect it from significant drops.

5. Setting Stop-Loss Orders:

Stop-loss orders are an essential tool for crypto trading. They automatically sell your asset when its price falls to a predetermined level, thus limiting your loss. Properly placed stop-loss orders can protect you from sudden market downturns.

6. Risk Management:

Effective risk management is vital. Only invest what you can afford to lose, and be wary of overexposure to high-risk investments. Regularly assess your portfolio to ensure it aligns with your risk tolerance and investment goals.

7. Technical Analysis and Indicators:

Learning basic technical analysis can help in making informed decisions. Indicators like moving averages, RSI (Relative Strength Index), and Bollinger Bands can provide insights into market trends and potential price movements.

8. Avoid Emotional Trading:

Market volatility can often lead to emotional trading. Fear of missing out (FOMO) or panic selling can result in poor decision-making. It’s crucial to maintain a level head and stick to your investment strategy.

9. Dollar-Cost Averaging (DCA):

Dollar-Cost Averaging involves regularly investing a fixed amount of money, regardless of the market’s condition. This strategy can reduce the impact of volatility, as you buy more when prices are low and less when they are high.

10. Stay Updated with Industry Developments:

The cryptocurrency market is still evolving, and regulatory changes or technological advancements can have a significant impact. Stay updated with industry news and trends to anticipate market movements.

11. Utilize Hedging Strategies:

Hedging involves taking an opposing position in a related asset to offset potential losses. Options and futures are common hedging instruments in the cryptocurrency market.

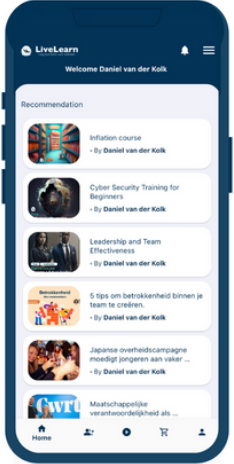

12. Invest in Crypto Asset Management Tools:

There are various tools and platforms designed to help manage and protect your crypto investments. These can provide automated trading, portfolio management, and risk assessment functionalities.

Conclusion:

Protecting your crypto assets from market volatility requires a combination of knowledge, strategy, and emotional control. By diversifying your portfolio, understanding market dynamics, and using tools like stop-loss orders and DCA, you can navigate the crypto market’s ups and downs more effectively. Remember, investing in cryptocurrencies involves risk, and it’s important to conduct thorough research and consider seeking advice from financial experts. As the market continues to evolve, staying informed and adaptable will be key to protecting and growing your crypto investments in 2024 and beyond.

What's your reaction ?

Follow us on Social Media

Some Categories

Recent posts

July 24, 2024

Navigating AI Implementation: Try these strategies to overcome resistance.

July 24, 2024

Sick Leave Policy Netherlands Guidance for HR and Entrepreneur.

July 24, 2024

CSRD Reporting: Mandatory Reporting on Corporate Sustainability.

July 24, 2024

Training Budget: Investing in Employee Development.

July 24, 2024

9 Reasons Why Small Businesses Should Outsource HR.

Inloggen

Inloggen

Registreren

Registreren

Comments (0)

No reviews found

Add Comment